Macroprudential Diagnostics No. 6

Introductory remarks

The macroprudential diagnostic process consists of assessing any macroeconomic and financial relations and developments that might result in the disruption of financial stability. In the process, individual signals indicating an increased level of risk are detected based on calibrations using statistical methods, regulatory standards or expert estimates. They are then synthesised in a risk map indicating the level and dynamics of vulnerability, thus facilitating the identification of systemic risk, which includes the definition of its nature (structural or cyclical), location (segment of the system in which it is developing) and source (for instance, identifying whether the risk reflects disruptions on the demand or on the supply side). With regard to such diagnostics, instruments are optimised and the intensity of measures is calibrated in order to address the risks as efficiently as possible, reduce regulatory risk, including that of inaction bias, and minimise potential negative spillovers to other sectors as well as unexpected cross-border effects. What is more, market participants are thus informed of identified vulnerabilities and risks that might materialise and jeopardise financial stability.

Glossary

Financial stability is characterised by the smooth and efficient functioning of the entire financial system with regard to the financial resource allocation process, risk assessment and management, payments execution, resilience of the financial system to sudden shocks and its contribution to sustainable long-term economic growth.

Systemic risk is defined as the risk of an event that might, through various channels, disrupt the provision of financial services or result in a surge in their prices, as well as jeopardise the smooth functioning of a larger part of the financial system, thus negatively affecting real economic activity.

Vulnerability, within the context of financial stability, refers to structural characteristics or weaknesses of the domestic economy that may either make it less resilient to possible shocks or intensify the negative consequences of such shocks. This publication analyses risks related to events or developments that, if materialised, may result in the disruption of financial stability. For instance, due to the high ratios of public and external debt to GDP and the consequentially high demand for debt (re) financing, Croatia is very vulnerable to possible changes in financial conditions and is exposed to interest rate and exchange rate change risks.

Macroprudential policy measures imply the use of economic policy instruments that, depending on the specific features of risk and the characteristics of its materialisation, may be standard macroprudential policy measures. In addition, monetary, microprudential, fiscal and other policy measures may also be used for macroprudential purposes, if necessary. Because the evolution of systemic risk and its consequences, despite certain regularities, may be difficult to predict in all of their manifestations, the successful safeguarding of financial stability requires not only cross-institutional cooperation within the field of their coordination but also the development of additional measures and approaches, when needed.

1. Identification of systemic risks

The second quarter of 2018 was marked by accelerated real economic activity resulting from growing exports and increased personal and government consumption. However, available monthly indicators for the third quarter point towards a slight slowdown in real economic growth (see CNB Bulletin, No. 245). The CNB also expects the growth of economic activity to decelerate slightly from 2017 (when it stood at 2.9%) on the entire-year level. Medium-term projections of the CNB suggest that the dynamics of real economic activity will remain similar, with slightly stronger reliance on domestic demand, and that macroeconomic imbalances will continue to decrease, having a positive effect on the overall structural vulnerabilities of the domestic economy. Despite reasonably favourable economic developments in the external environment, total risks increased somewhat due to geopolitical and trade uncertainties, which is why euro area real economic activity could grow at a slower pace than previously anticipated.

In spite of favourable cyclical real developments, the overall exposure to systemic risks did not change from the last issue (see Macroprudential Diagnostics, No. 5), remaining at a moderate level (Figure 1). This may be accounted for by persisting structural weaknesses in the domestic economy.

Figure 1 Risk map for the third quarter of 2018

Note: The arrows indicate changes from the risk map in the second quarter of 2018 published in Macroprudential Diagnostics, No. 5.

Source: CNB.

Favourable fiscal developments continued in the second quarter of the current year. The downward trend in the public debt-to-GDP ratio, observed for several years now, caused the risk of fiscal sustainability to decline further, resulting in the continuous improvement in the risk perception of Croatia. Following the upgrade of Croatia's credit rating by credit rating agencies Standard & Poor's and Fitch Ratings in early 2018, Standard & Poor's raised Croatia's credit rating outlook in September, while Fitch Ratings did the same in July. The second quarter witnessed favourable developments in other important macroeconomic indicators as well; however, as their level is still very high, the structural vulnerabilities of the non-financial sector are still assessed as moderate, and the domestic economy remains highly vulnerable to a possible tightening of financing conditions in international markets.

The structural vulnerabilities of the financial system remained moderate, with the main sources of vulnerability in the sector mainly stemming from the high concentration of the banking market, exposure concentration and the currency and interest rate structure of private sector loans. These vulnerabilities are partly mitigated by the high levels of capitalisation and liquidity of the domestic banking sector, but also by the continued decrease in the exposure to currency-induced and interest rate-induced credit risk. Croatia is one of the countries with the most concentrated banking systems in the EU, and this relatively high level of banking market concentration constitutes one of the system's structural weaknesses (see Box 1 The effect of banking system concentration on financial stability). Banking system structure can contribute considerably not only to the materialisation of particular risks, such as the liquidity risk or solvency risk, but also, through spillover and contagion channels, to their transmission to the system as a whole.

The exposure of the household and non-financial corporate sector to current risks remained relatively low. In the household sector, this was mainly due to favourable labour market developments, an increase in disposable income and financial assets, lower interest rate expenditures and the higher propensity to borrowing in the domestic currency and at a fixed interest rate. On the other hand, the total debt of the household sector is still primarily linked to variable interest rates, making such debtors potentially vulnerable to a possible rise in future interest rates, while the unemployment rate is still relatively high. As regards the non-financial corporate sector, favourable short-term developments are primarily a result of good business performance of non-financial corporations. The future development of risks in this sector partly depends on the implementation of the operational restructuring of the Agrokor Group as well as on the foreign demand for Croatian exports, which is expected to decelerate slightly in the medium term as a result of expected lower growth rates of imports of Croatia's main trading partners.

Identified current developments in the financial sector are still considered favourable. This is primarily a consequence of the relatively low level of the domestic component of the financial stress indicator resulting from lower volatility in the domestic foreign exchange market and the domestic capital market. On the other hand, the foreign component of the financial stress indicator continued to grow moderately due to the increased risk premium of Italian banks and the slightly higher volatility expected in international equity markets, which is still, nevertheless, below its low-term average.

2. Potential triggers for risk materialisation

Potential triggers that could lead to the materialisation of risks have mostly remained the same as described in the analysis in the previous publication (see Macroprudential Diagnostics, No. 5). The most significant identified potential triggers include the developments in the international environment, and, to a lesser extent, the operational restructuring of the Agrokor Group.

A possible rise in instability in the international environment, primarily associated with an increase in global risk aversion as a result of further escalation of trade protectionism and growing instability in international financial markets, is currently the most obvious potential trigger for risk materialisation. It is necessary to note that total short-term risks for global financial stability are gradually rising and could intensify should there be a stronger than expected normalisation of monetary policy in the developed countries and a sharper tightening of global financial conditions.

Figure 2 Monetary policies of the USA and the euro area

Notes: The figure shows Fed and ECB benchmark interest rates. The forecast indicated by a broken line represents market expectations, while dots show FOMC expectations from the September 2018 meeting.

Sources: Fed and ECB (actual rates) and Bloomberg (forecast).

The normalisation of the US monetary policy (Figure 2) and growing political uncertainty led to intensified capital outflows and increased instability in some emerging markets such as Argentina and Turkey. In contrast, Croatia is significantly less exposed to the effects of tightened financial conditions for dollar borrowing as it does not borrow in the dollar market and its existing US dollar-denominated debt is, for the most part, hedged against the risk of USD/EUR exchange rate change. Still, Croatia could suffer indirect consequences in the event of contagion across emerging markets. Furthermore, a more pronounced slowdown in the economic growth in euro area countries, particularly in Croatia's important trading partners such as Italy and Germany, driven by a possible slowdown in global trade, could have an unfavourable impact on economic activity in Croatia. The recent increase in the yield on Italian government bonds, which caused a rise in the risk premium of Italian banks, is another potential risk trigger that could spill over to other European markets. As a result, Croatia, as a country with accumulated structural imbalances, remains highly vulnerable to unfavourable developments in the international environment and to a potential deterioration in the financing conditions on international markets. The rise in interest rates and higher borrowing costs would increase the debt servicing burden and possibly have an unfavourable impact on the long-term fiscal sustainability in Croatia. This could additionally weaken the domestic economy and, ultimately, have an unfavourable impact on the banking sector.

Potential triggers for risk materialisation stemming from the domestic environment are not considered significant. With the creditors' approval of the Agrokor Group debt settlement deal in July, a framework for the Group's restructuring was adopted, including a substantial write-off of financial liabilities to creditors. This has reduced the uncertainty regarding Agrokor's future business operations, although the process is not yet completed: the implementation of the settlement is expected at the beginning of next year, pending approval by the commercial court. The operational restructuring of the Agrokor Group is also an ongoing process which could, to a certain extent, have an unfavourable impact on the labour market and investment activity in Croatia. Similarly, possible unfavourable effects of risk materialisation arising from the instability in the business operations of the Uljanik Group should not have a significant effect on overall economic activity or the business operations of the financial sector. However, due to issued government guarantees, the discontinuation of the Group’s business operations could have a somewhat unfavourable impact on public finance and employment on a local level, considering that the Uljanik Group is among major employers in Istria and the Croatian Littoral.

Box 1 The effect of banking system concentration on financial stability

The structure of the banking system and its effect on systemic risk pose significant challenges to regulators and economic policy makers. Due to globalisation processes, fintech innovations and progress in the functioning of the EU single market, this could become even more pronounced in the upcoming period. Although systems with a smaller number of large banks have possible advantages associated with greater efficiency, the higher degree of system concentration may have an unfavourable effect on systemic risk. A highly concentrated system may cause a rapid transformation of an initially non-systemic risk into a systemic risk via spillover and contagion channels and, under extreme conditions, result in financial instability. The regulator therefore has the task of monitoring the concentration of the financial system, recognising its implications for the stability of that system and, if necessary, taking regulatory action to safeguard financial stability.

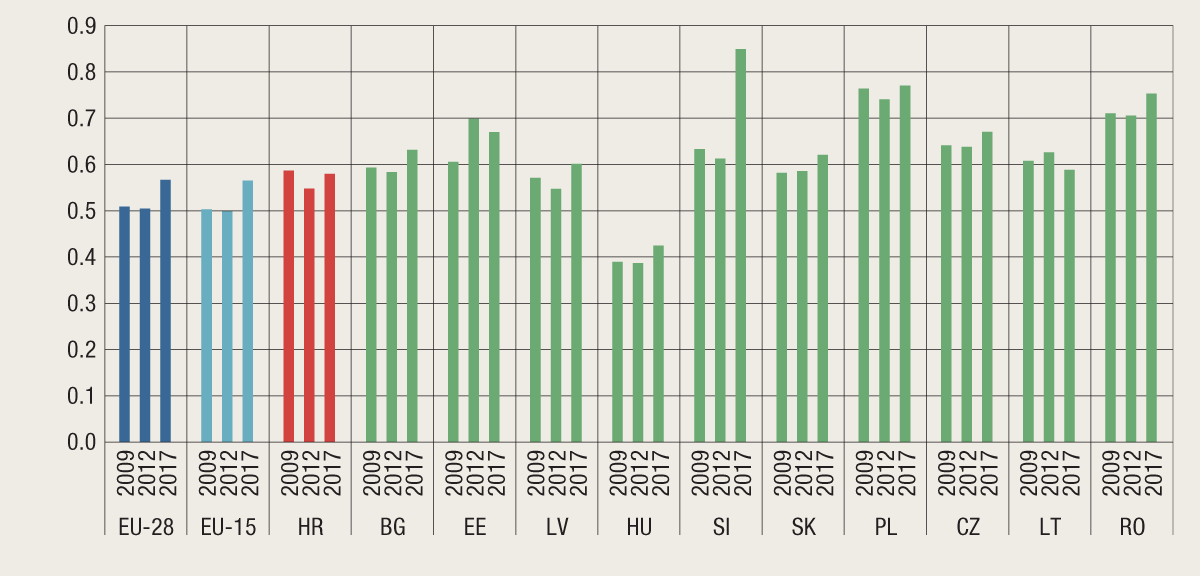

The liberal issuance of bank authorisations seen in Croatia in the 1990s brought about an increase in the number of banks; however, since the banks in question were mainly smaller domestic banks, with older regional banks retaining large market shares in their areas, the degree of banking system concentration was not significantly reduced (Kraft et al., 2004). The banking crisis and the consequential exit of some banks from the market in Croatia at the turn of the millennium led to a short-term increase in system concentration. In the several years that followed until the onset of the global financial crisis, the number of banks was relatively stable, while concentration indicators even suggested that market concentration fell (Figure 1). However, after the crisis, market concentration began to trend up and the number of credit institutions dropped, so that by mid-2018, the number of banks in the system had declined by a half from 1999. Furthermore, the forthcoming merger of two other systemically important credit institutions (O-SIIs) and the acquisition of two smaller credit institutions by systemically important credit institutions[1] will additionally increase banking system concentration. The growth in market concentration in the post-crisis period is not only typical of Croatia, but is a usual consolidation pattern in which particular banks, faced with rising losses, exit the market. In a large number of EU countries, market concentration grew relative to the pre-crisis period; in some countries, the rise was even more significant than in Croatia (Figure 2). In certain banking systems, concentration grew in the pre-crisis period as well. This was generally due to overbanking, or the presence of weaker banks, overindebtedness and the consequently high levels of non-performing exposures, as well as strong market regulation leading to more expensive operations in the EU single market. Despite that, according to market concentration indicators at end-2017, Croatia's banking system is one of the most concentrated banking systems in the EU (Figure 2).

Figure 1 The longstanding trend of rising banking system market concentration in Croatia

Note: The level of concentration of observed items is indicated by the Herfindahl-Hirschman index of concentration.

Source: CNB.

Figure 2 Croatia's banking system was among the most concentrated systems in the EU at end-2017

Sources: CNB and ECB.

The relation between market concentration and banking sector business operations is not easy to determine distinctly, as is evident from the relation between market concentration (measured by the HHI index) and the selected banking system indicators shown on a sample of 28 EU countries (Figure 3). The figure shows that the relation between market system concentration and the level of risk taking (measured by the level of value adjustment expenses), bank price management (measured by the net interest margin) and the financial stability indicator (measured by the Z-index) is very weak. Only operational efficiency (measured by the operating cost-to-income ratio) is somewhat more closely linked to market concentration and points to higher cost efficiency in concentrated systems. This shows that the influence of market concentration on bank behaviour, and indirectly on financial stability, is very complex and that the nature of that influence depends on other system characteristics as well.

Higher concentration is often associated with possibly lower market competition, but it is important to note that there is no general agreement on the nature of the relation between them (Claessens and Laeven, 2004 examine the usefulness of using concentration as a measure of market competition) or on the effect of competitiveness on the stability of the financial system[2]. Concentration is a narrower term because it refers only to system structure, i.e. the share of particular institutions in the market, while competition refers to the market power, e.g. the ability to raise prices or reduce supply. Although the largest domestic banks in Croatia have not necessarily always used their market power to influence prices (Kraft and Huljak, 2018), the CNB has recognised the increased need to monitor the links between competitiveness and banking system stability. It has therefore adopted macroprudential policy measures with the aim of reducing potential negative effects of the market power of particular banks. The Decision on the content of and the form in which consumers are provided information prior to contracting individual banking services and the Information list with the offer of loans for consumers are aimed at reducing the asymmetry of information between the debtor and the creditor by reducing the space for possible unjust price setting in the area of banking services.

Figure 3 Relation between the average level of market concentration and selected variables after 2008

Notes: The figure shows average values of indicators for the period between 2008 and 2017. The Z-index is the widely accepted indicator of individual bank stability, calculated as: , where is the equity-to-asset ratio, is the average return-on-assets indicator (in the observed period), and is the volatility of earnings (standard deviation of the return on assets in the observed period). A higher index indicates higher bank stability, while a lower index points to a risk of bank failure.

Source: ECB.

Although the nature of the effect of market competition on financial stability is relatively complex, the effect of the banking market structure on systemic risk is very simple and intuitive. Higher system concentration increases the dynamics and the potential of risk development through spillover and contagion channels, causing it to transform into a systemic risk or even result in financial instability under extreme conditions. For instance, a systemically important bank faced with liquidity problems may put significant pressure on the interbank liquidity market and, in certain conditions, even cause liquidity problems in other banks. In addition to the liquidity channel, systemically important banks may have a negative influence on the solvency of other banks should a fire-sale of its long-term financial assets (real estate, shares, bonds) result in a sudden adjustment of their prices. The potential transmission of systemic risk through the operations of systemically important banks in Croatia is also evident from the fact that a large number of household loans has been granted with a variable interest rate linked to the NRR[3] (at end-August 2018, their share in total household loans stood at 33%). Due to the methodology of calculation of this variable parameter, problems in one systemic bank that could lead to a significant increase in the price of the bank's financing sources may indirectly result in a rise in interest rates on all loans linked to the parameter, which would, in turn, increase credit risk at the level of the entire system.

Structural vulnerabilities, including the high market concentration of the banking system, have been recognised by the CNB in its capacity as the macroprudential policy maker as well. Therefore, since 2014, such risks have been covered by the systemic risk buffer (SRB), which identifies two groups of credit institutions to which respective SRB buffer rates are applied, depending on the complexity of their activities and their interconnectedness[4]. Furthermore, in 2016, the systemically important credit institutions buffer (O-SII) was introduced for all banks deemed significant, i.e. systemically important on account of their size, interconnectedness and significant cross-border activities[5]. In order to determine and review the systemically important credit institutions buffer, the CNB applies the methodology and the criteria in line with the guidelines of the European Banking Authority[6], using at least one of the following conditions: institution size, its importance for the economy of the EU or Croatia, the significance of its cross-border activities and its interconnectedness or the interconnectedness of its group with the financial system. In that way, the CNB indirectly takes into account market power when setting this buffer. The assumption on the unfavourable relation of exposure concentration and the stability of a particular bank (increase in concentration has a negative effect on stability) is used in the supervisory review and evaluation process (SREP) conducted by the CNB as the supervisory authority. In order to assess the resilience of the banking system to concentration risk for internal purposes, the knock-on effect is regularly simulated for a failure of a debtor within a group of affiliated persons, where the higher concentration of exposure to a group of affiliated persons results in heavier losses for a credit institution. In addition, indicators of market concentration of the banking system and the concentration of bank exposure is regularly monitored in the analysis of systemic risks whose results are published in the map of systemic risks (see 1 Identification of systemic risks).

To conclude, in a period of relatively high and continuously increasing concentration of the domestic banking system, and with regard to the development of fintech innovations and the progress in the functioning of the EU single market (for more information, see Box 4 The single passport and its impact on financial stability in Financial Stability, No. 17), the CNB, within its mandate, continuously monitors and recognises concentration as a structural vulnerability of the banking system and implements macroprudential policy measures aimed at mitigating the negative contribution of system concentration to financial stability accordingly.

Recent macroprudential activities

3.1 Continued application of the countercyclical capital buffer rate for the Republic of Croatia for the fourth quarter of 2019

Despite the continued recovery of lending activity, the results of the analytical assessment of the development of cyclical systemic risks suggest that there are still no pressures requiring correction by the CNB. According to the data for the second quarter of 2018, the moderate increase in the stock of total domestic and foreign placements to the non-financial sector was accompanied by the relatively stronger growth in nominal GDP, leading to a further decrease in the ratio of placements to GDP. The credit gap calculated on the standardised ratio remained negative, as confirmed by the specific indicators of relative indebtedness based on a narrower definition of loans (loans of domestic credit institutions relative to the quarterly, seasonally adjusted GDP). Accordingly, the Croatian National Bank issued the Announcement of the application of the countercyclical buffer rate for the Republic of Croatia for the fourth quarter of 2019 of 0% in September.

3.2 Overview of macroprudential measures in EU countries

The continued upward phase of the credit cycle and increasing real estate prices, particularly in the segment of residential real estate motivated several EU countries to introduce new and/or tighten existing macroprudential measures. In late June 2018, the United Kingdom became the sixth country to apply the non-zero countercyclical capital buffer. Bulgaria announced that it would begin applying the countercyclical capital buffer rate of 0.5% in 12 months, which resulted in a total of eleven countries that will apply a non-zero countercyclical capital buffer rate as of the third quarter of the following year. Moreover, in the third quarter of 2018, two countries increased the applicable rates (the Czech Republic from 0.5% to 1.0% and Slovakia from 0.5% to 1.25%) and announced an additional increase to be applied as of 2019. An increase in the rate to be applied in 12 months’ time was also announced by Denmark (from 0.5% entering into force on 31 March 2019 to 1% to be applied as of 30 September 2019) and Sweden (from the current 2% to 2.5%).

In June 2018, the Czech central bank issued a recommendation on the management of risks associated with the provision of retail loans secured by residential property (since the central bank does not have a legal mandate to adopt binding guidance related to mortgages, a recommendation was issued instead of a formal measure). The bank's move was motivated by concern over the observed increase in systemic risks arising from the growth in loans secured by residential property and rising property prices amid historically low interest rates and relaxed lending conditions. Among other things, the loan to collateral value (loan-to-value, LTV) ratio is recommended not to exceed 90%, the ratio of a client's total debt to income (debt-to-income, DTI) not to exceed nine, and the ratio of a client's average annual debt repayment expenses to the client's annual income (debt service-to-income, DSTI) not to exceed 45%. In the same month, Slovakia's central bank also tightened its macroprudential measures introduced earlier with the aim of mitigating the risks associated with the fast growth in household lending (particularly in the segment of housing, but also in that of consumer loans), which is causing a substantial increase in household debt. The allowed loan-to-value ratio has thus been set at no more than 90% (from the earlier 100%), with only 20% of new loans secured by real estate allowed to have an LTV ratio above 80%. In addition to existing borrower-based measures (restriction of the share of debt repayment expenses in total income, restriction of maximum maturity, obligatory annuity repayment without a grace period or increasing repayment expenses), a new restriction has been introduced for all housing and consumer household loans according to which the borrower's total indebtedness cannot exceed eight times his or her yearly net disposable income (with a very strict definition of disposable income).

Also in June 2018, Finland adopted the decision on the activation of a systemic risk buffer (1% for all credit institutions, with the exception of the three largest credit institutions with rates of 1.5%, 2% and 3%), to be applied as of 1 July 2019. The decision was adopted based on the increase in systemic risks in Finland compared with historical developments and other EU member states, measured by indicators such as: share of housing loans in total household loans, share of claims on construction and real estate investment companies in the credit institutions' total claims, credit institution sector concentration, relative household sector debt, etc. Sweden adopted the decision to abolish the minimum risk weight of 25% for all loans secured by real estate (for banks applying the IRB approach to calculate minimum capital requirements for credit risk) applied under Pillar 2 of the Basel II framework. An equivalent measure has been introduced instead pursuant to Article 458 of the Regulation on prudential requirements for credit institutions and investment firms, which, in contrast to measures applied under Pillar 2, comprises a clearly defined procedure for requesting reciprocity of national macroprudential measures.

Table 1 Overview of macroprudential measures in EU countries

Disclaimer: of which the CNB is aware.

Notes: Listed measures are in line with Regulation (EU) No 575/2013 on prudential requirements for credit institutions and investment firms (CRR) and Directive 2013/36/EU on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms (CRD IV). Definitions of abbreviations are provided in the list of abbreviations at the end of the publication. Green indicates measures that have been added since the last version of the table, while red indicates measures that have been deactivated.

Sources: CNB, ESRB and notifications from central banks and websites of central banks as at 20 September 2018.

For more details see: https://www.esrb.europa.eu/national_policy/html/index.en.html.

Table 2 Implementation of macroprudential policy and overview of macroprudential measures in Croatia

Notes: Definitions of abbreviations are provided in the list of abbreviations at the end of the publication. Green indicates measures that have been added since the last version of the table. Source: CNB.

Analytical annex: Reducing the vulnerability of the non-financial corporate sector

The vulnerability of the non-financial corporate sector, monitored within the risk map[7] shown in Chapter 1, has been trending downwards since 2012 (see also Financial Stability, No. 19, Chapter 4). The total debt of Croatian corporations has been declining over the past several years, primarily under the direct influence of negative exchange rate differences and price adjustments and write-offs (partly due to the sale of claims). Even though corporations have recently been taking on more new debt than they have been repaying old liabilities, their level of debt has remained the same (having stagnated in the first half of 2018 from the end of 2017) owing to the aforementioned factors. At the same time, operating revenues, profits and equity are growing, causing the total debt repayment burden to shrink.

Observing other EU member states, it is evident that the average corporate debt in the countries of the so-called "new EU" is lower than in "old EU" member states. Furthermore, in most peer "new EU" member states, corporate debt has been declining over the past several years; in some countries, the rate of decline is even higher than in Croatia (with the exception of Poland and Slovakia, where corporate debt is rising, albeit from extremely low levels). In contrast, corporate debt in the "old EU" (EU15) has been increasing slightly over the past several years, supported by abundant liquidity amid low interest rates. Debt securities are increasingly being used as a source of financing in EU15, while credit debt is slowly decreasing. On the other hand, in "new EU" member states, corporations are still traditionally financed by credit institutions, within their group of affiliated enterprises or, to a lesser extent, via liabilities to suppliers, while financing by debt securities is rare and steadily declining. This is primarily due to structural reasons such as the underdeveloped debt security market, high sovereign risk premiums, high fixed costs of issue and insufficient supply of financial instruments for hedging against risk (primarily against currency and interest rate risk).

By reducing debt, corporations reduce their exposure to credit risk, but this does not necessarily have to lead to a sustainable degree of risk, particularly when high levels of indebtedness are considered. Taking a sample of "new EU" member states, Comunale et al. (2018) conclude that the debt of Croatia's and Bulgaria's private sector exceeds the balanced level based on macroeconomic factors, indicating an increased degree of risk. It is therefore important to observe individual components of credit risk, i.e. the ability of a corporation to settle due obligations in the short (liquidity) and long term (solvency).

The liquidity of Croatian corporations, measured by the quick ratio (Figure 2), is close to the European average, although it is slightly lower than in peer countries. In almost all countries, the liquidity of corporations has grown over the past five years, reducing their vulnerability. Broken down by activities, the manufacturing industry is characterised by higher liquidity, probably on account of higher claims on clients to whom manufacturers grant longer delays in payment, while below-average liquidity is observed in tourism, likely due to the high seasonality of business.

Furthermore, most "new EU" member states saw an improvement in corporate solvency (Figure 3). The solvency risk indicator in Croatia is below one, since total debt does not exceed the total level of corporate equity, and its steady decrease over the past five years has been supported by shrinking debt and increasing corporate equity. The risk has been declining in other "new EU" member states as well, primarily thanks to the rise in corporate equity brought about by good business performance and retained earnings. Broken down by activities, in most countries, an above-average solvency risk is observed in tourism (see Macroprudential Diagnostics, No. 3, Analytical annex: Risk of non-financial corporations providing accommodation and food services) and construction, which may be accounted for by high financial investments in tangible assets (buildings) and working capital for business operations (employee expenses and costs of other services). Although Croatian corporations in tourism have recently been accumulating considerable debt, the relatively faster growth in their equity results in lower solvency risk.

Based on the developments seen in the aforementioned indicators, we may conclude that, for short-term financing, Croatian corporations have recently been increasingly using their own sources of financing and the sources of financing of their parent companies, or have been financing themselves through suppliers. The trend may be attributed to long-standing problems stemming from recession and is observed in spite of the general decline in interest rates. Martinis et al. (2017) have also shown that the Croatian corporate debt overhang has a negative effect on corporate investment activity and that reducing excessive indebtedness is a prerequisite for sustainable business. However, economic growth is giving rise to an increased need for additional long-term investments and their financing, which could motivate more vigorous borrowing in the future. Since solvency has been brought to a stable level (close to the value of equity) and liquidity has improved as well, in order to sustain a stable outlook and a low level of vulnerability, the growth rate of total corporate debt has to remain below the level of equity growth, which may be achieved by partial financing from retained earnings, more active management of the relationship between corporate assets and liabilities and more effective internal risk management.

Figure 1 Non-financial corporate debt in the EU

Notes: Debt is measured by the share of total non-consolidated credit liabilities and debt securities of the non-financial corporate sector in GDP. In 2010, Romania conducted significant debt restructuring through pre-bankruptcy settlements, assignments, write-offs, etc., resulting in a significant drop in non-financial corporate debt.

Source: Eurostat, financial accounts.

Figure 2 Quick ratio (receivables + cash/current liabilities)

Notes: Receivables (rec.) are short-term receivables from customers (DEBT), cash includes cash in bank and cash in hand (CASH), current liabilities (CULI) include short-term credit liabilities, liabilities to suppliers and other short-term liabilities (liabilities to employees, tax obligations and liabilities to the government, advance payments and intra-group short-term liabilities). Construction includes real estate activities.

Source: Orbis Europe, BvD[8].

Figure 3 Solvency risk indicator (total financial debt/equity)

Notes: Total financial debt = long-term financial debt (LTDB) + short-term financial debt (LOAN) + debt to creditors (CRED), equity = shareholders' funds (SHFD) including the initial capital, retained earnings for the period and reserves. Calculated indicators are based on proxies that represent the financial position in the best way possible.

Source: Orbis Europe, BvD.

References

Claessens, S., and L. Laeven (2004): What drives bank competition? Some international evidence, Journal of Money, Credit and Banking 36 (3), pp. 563-83.

Comunale, M., M. Eller, and M. Lahnsteiner (2018): Has private sector credit in CESEE approached levels justified by fundamentals? A post-crisis assessment, OeNB, Issue Q3-18, pp. 141-154.

Kraft, E., R. Hofler, and J. Payne (2004): Privatization, Foreign Bank Entry and Bank Efficiency in Croatia: A Fourier-Flexible Function Stochastic Cost Frontier Analysis, CNB Working Papers, W-9.

Kraft, E., and I. Huljak (2018): How Competitive is Croatia’s Banking System? A Tale of Two Credit Booms and Two Crises, CNB Working Papers, W-54.

Martinez-Miera, D., and R. Repullo (2010): Does Competition Reduce the Risk of Bank Failure?, Review of Financial Studies, 2010, Vol. 23, Issue 10, pp. 3638-3664.

Martinis, A., and I. Ljubaj (2017): Corporate Debt Overhang in Croatia: Micro Assessment and Macro Implications, CNB Working Papers, W-51.

Rajan, Raghuram G. (1994): Why bank credit policies fluctuate: A theory and some evidence, Quarterly Journal of Economics 109 (2), pp. 399-441.

-

In June 2018, Prva stambena štedionica was acquired by Zagrebačka banka, while Privredna banka Zagreb acquired Veneto banka in October 2018. ↑

-

In the model proposed by Rajan (1994), bank competition is a key factor in an excessive loan supply and a higher level of risk assumption of banks, because the remuneration of bank employees whose activities have a significant effect on the risk profile depends on the bank's relative efficiency. Other models assume an inverse correlation between competition and banks' risk assumption, whereby, in the absence of competition, banks may impose relatively high interest rates on clients in order to achieve higher interest margins, which again results in an increase in credit risk in the system (Martinez-Miera, Repullo, 2010). ↑

-

The national reference rate of the average financing cost of the Croatian banking sector (NRR) is the average cost of the funding sources of the Croatian banking sector (banks and savings banks) within a particular period, depending on the type of source (deposits of natural persons, deposits of legal persons from the non-financial sector, other funding sources of banks) and the relevant currency. ↑

-

Decision on the application of the structural systemic risk buffer (OG 78/2017). ↑

-

Since other systemically important institutions (O-SIIs) are required to maintain the SRB as well, applied to all exposures, in effect they maintain only the higher of the two buffer rates, which is currently the SRB. ↑

-

Guidelines on the criteria to determine the conditions of application of Article 131(3) of Directive 2013/36/EU (CRD) in relation to the assessment of other systemically important institutions (O-SIIs). ↑

-

The main risks in the assessment of corporate vulnerability include the liquidity risk as the short-term (in)ability to settle due liabilities, the solvency risk, measuring the uncertainty regarding the settlement of liabilities in the long term, and the risk of inertia as the reduced capability of changing the corporation's current financial position. Only the first two risks are analysed in this annex, while the risk of inertia has been omitted from the analysis due to inconsistencies in the data for particular countries. ↑

-

The quick ratio (Figure 2) and the solvency risk indicator (Figure 3) have been calculated on an individual basis for Croatian enterprises and enterprises in "new EU" member states and on an aggregate basis for EU28 enterprises and EU15 ("old EU") enterprises. Since only the available "standardised" templates of annual financial statements (balance sheets and income statements) have been used, depending on the country, certain differences and inconsistencies are possible in the calculation of individual indicators as a result of accounting inconsistencies, inability to precisely and uniformly map local financial positions of reports within a standardised format and other possible systematic data errors. ↑