Statistical releases provide a summary of the most recent values and trends for the published statistical indicators series compiled by the Croatian National Bank.

Statistics

- Release calendar

- Statistical releases

- Indicators of banking system operations

- Main macroeconomic indicators

-

Statistical data

-

Financial sector

- Republic of Croatia contribution to euro area monetary aggregates

- Consolidated balance sheet of MFIs

- Central bank (CNB)

- Other monetary financial institutions

- Other financial corporations

- General government sector

- External sector

- Financial accounts

- Securities

- Selected non-financial statistics

- Payment systems

- Payment services

- Currency

- Turnover of authorised exchange offices

- Archive

-

Financial sector

- SDDS

- Regulations

- Information for reporting entities

- Information for users of statistical data

- Use of confidential statistical data of the CNB for scientific purposes

- Statistical surveys

- Experimental statistics

Statistical releases

General government debt statistics for June 2023

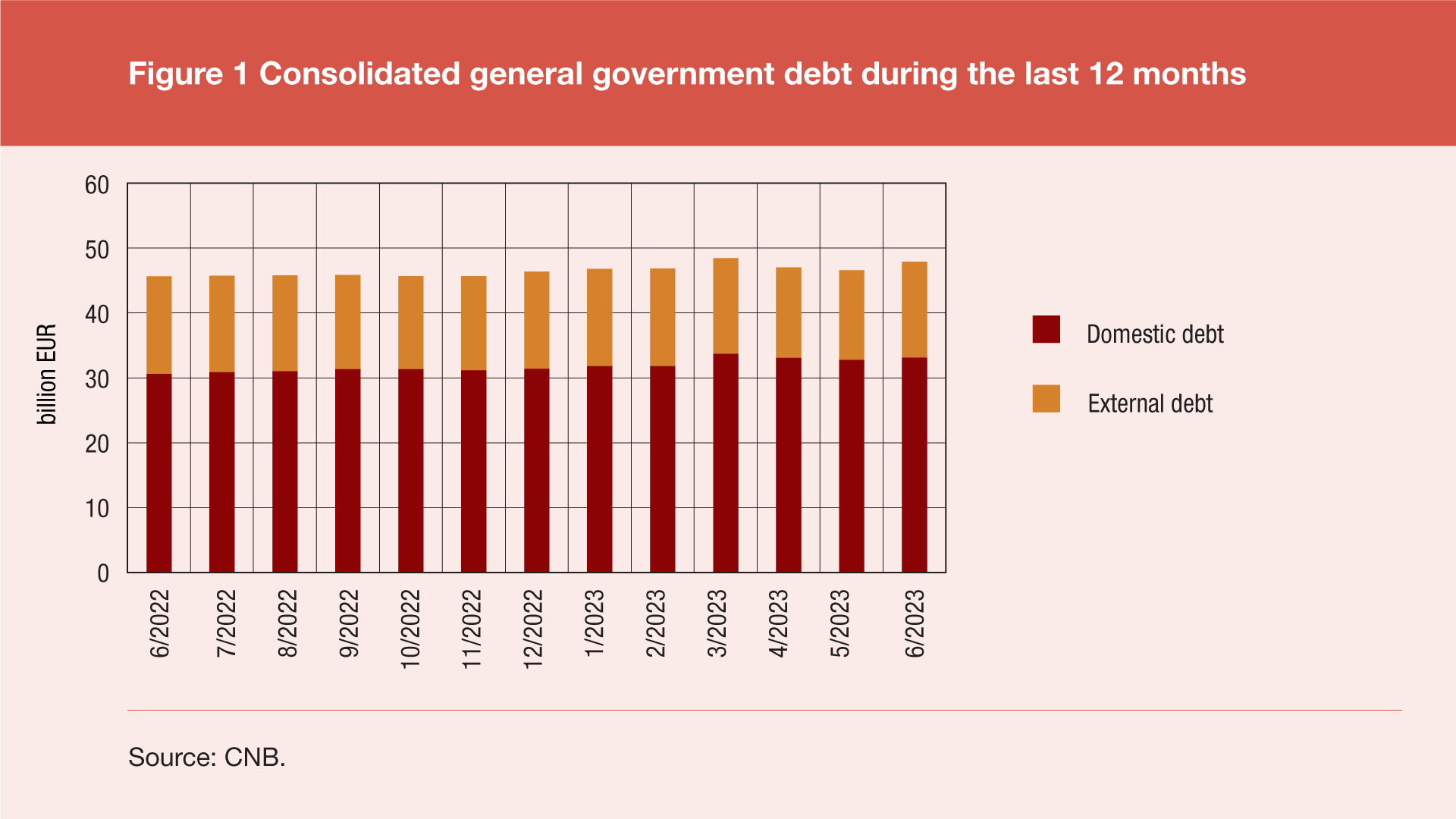

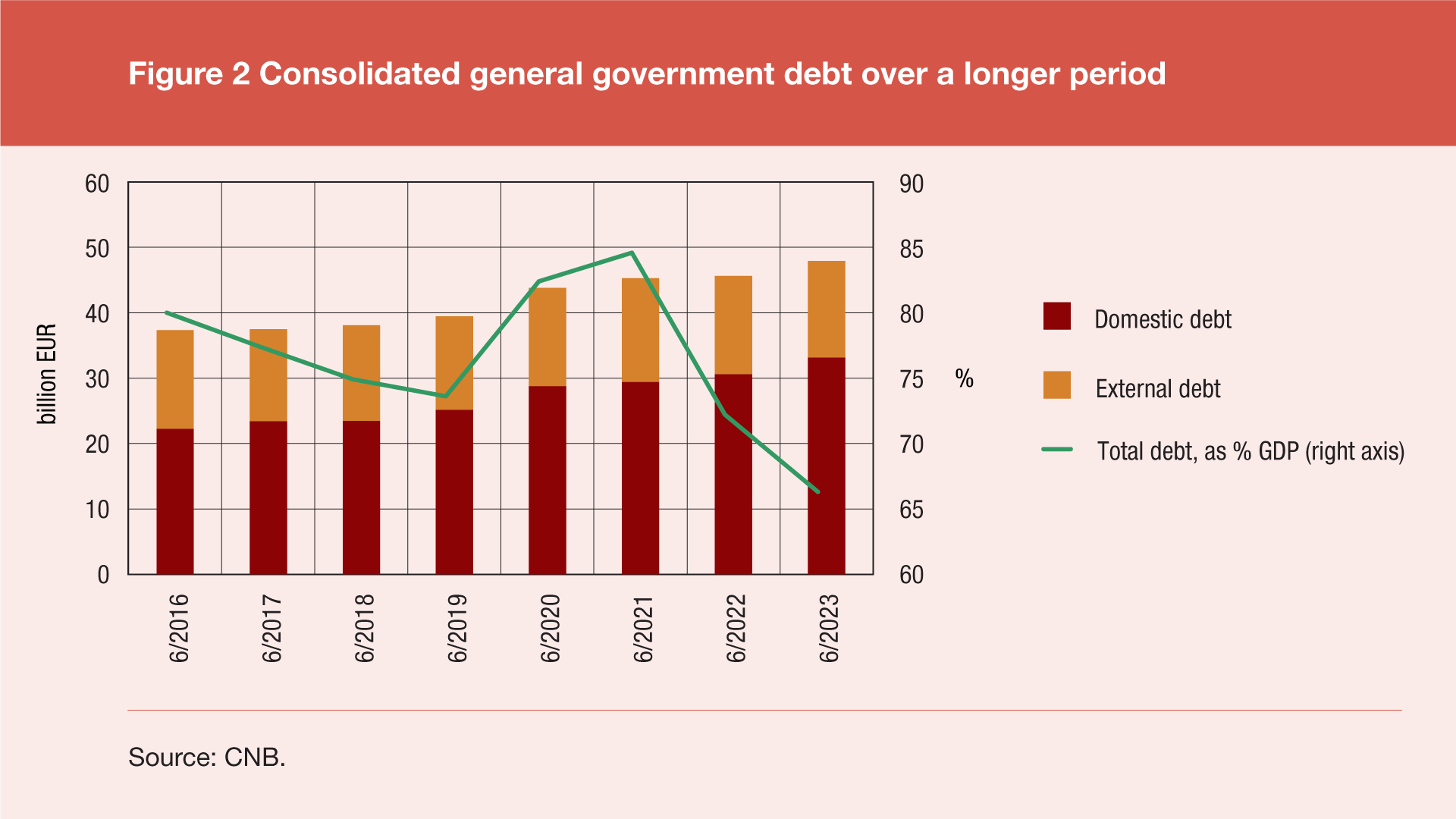

According to the final[1] data of government finance statistics for the second quarter of 2023, the total consolidated debt of all general government sub-sectors[2] reached EUR 47.9bn at the end of June 2023, down by EUR 0.5bn (or 1.1%) from the end of March 2023 and up by EUR 2.3bn (or 5.0%) from the end of June 2022. The annual increase in debt was due to a combination of a decrease in the external debt of EUR 0.27bn (or 1.8%) and an increase in the domestic debt of EUR 2.54bn (or 8.3%). Domestic debt fell by EUR 0.57bn (or 1.7%), and external debt rose by EUR 0.05bn (or 0.4%) compared to the end of the previous quarter.

Measured against the annual GDP[3], the total debt at the end of June 2023 amounted to 66.5% of GDP, which is a decrease of 5.9 percentage points on an annual basis from 72.4% of GDP at the end of June 2022 and a decrease of 2.6 percentage points from the end of the previous quarter, when this share stood at 69.1%.

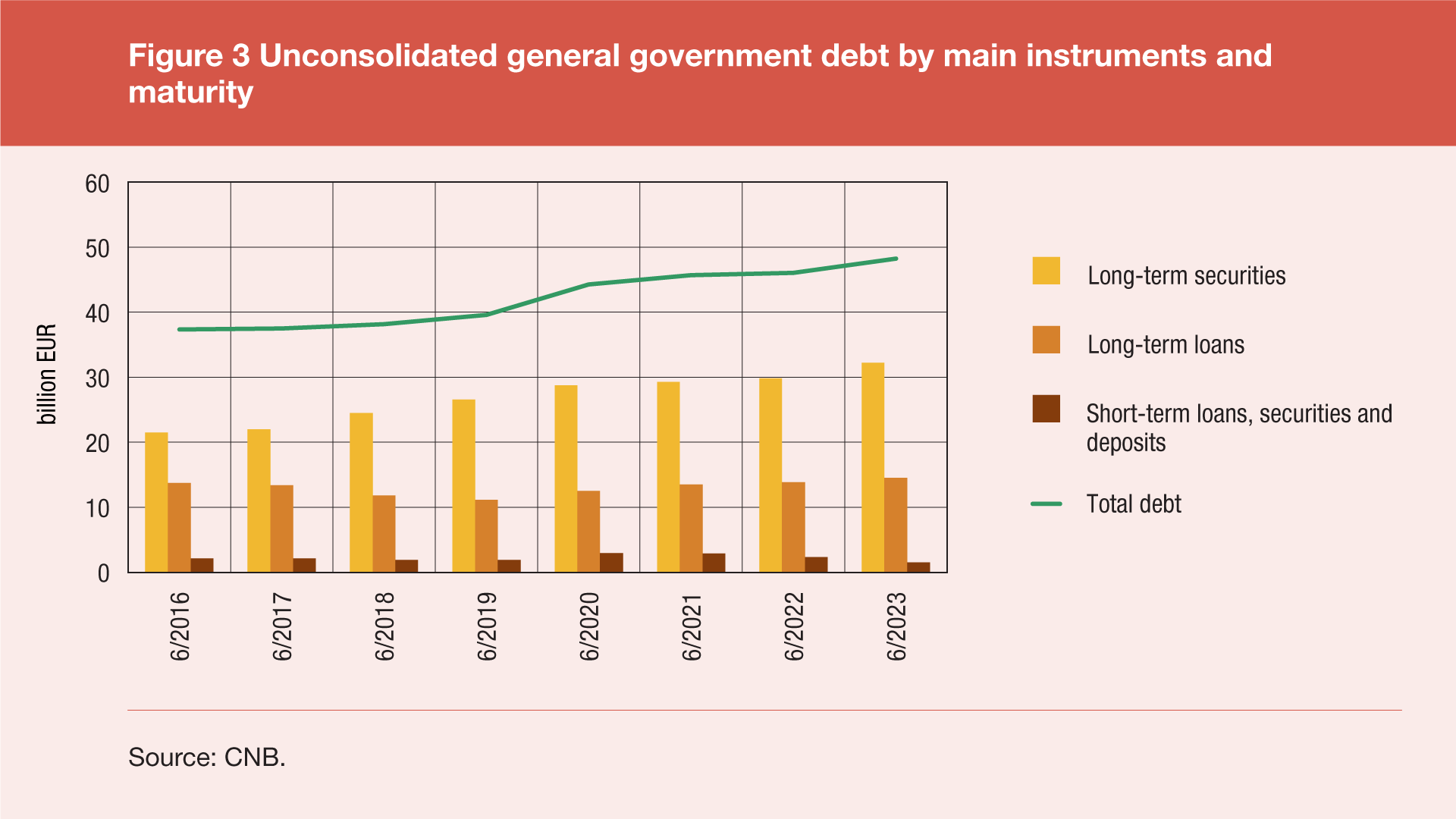

The general government debt structure by main debt instruments and maturity is available only on an unconsolidated basis[4]. Long-term debt instruments dominate the maturity structure of unconsolidated debt: at the end of June 2023 most of this debt was made up of bonds (66.8%), the second by importance were long-term loans (30.1%), and last were short-term loans, securities and deposits (jointly 3.1%). The short-term debt components decrease by EUR 0.8bn (or 35.3%) on an annual basis from the end of June 2022 to the end of June 2023, while the long-term debt components increase by EUR 3.0bn (or 6.9%) during the same period.

Statistical time series: Table I3 General government debt (ESA 2010)

-

Data are confirmed by EUROSTAT within EDP notification process. ↑

-

This debt excludes the cross claims of institutions within the same sub-sector and between sectors, the so-called Maastricht debt. ↑

-

Calculated as the sum of the preceding four quarterly GDP figures. ↑

-

The unconsolidated debt represents the Maastricht debt increased by cross claims of different units within the general government sector. ↑